Real-World Asset Tokenization Explained, and How to Build with Them Using Tatum

Tokenizing real-world assets (RWAs) is no longer a concept, it's a market reality.

Traditional financial instruments such as government bonds and real estate together with gold are shifting to blockchain technology

At Tatum, we’re making it simple for developers to build with RWAs. That’s why we’ve added Lumia, a purpose-built RWA chain. And it’s why we support major chains like Ethereum and Polkadot, where RWA innovation is already underway.

- RWAs are tangible, off-chain assets represented as tokens on blockchain

- The RWA market exceeds $230B while continuing rapid expansion

- Major institutions like BlackRock, JPMorgan & Fidelity are all entering the space

- Tatum gives developers tools to build RWA apps across multiple chains

- Lumia, a new RWA chain built with Polygon CDK, is now live on Tatum

- Ethereum & Polkadot are also supported for RWA-related development

RWAs are the fastest-growing narrative in institutional crypto:

| Figure | Description |

|---|---|

| $230B+ | RWA market size as of mid-2025 |

| 539% | Growth in tokenized treasuries since Jan 2024 |

| $5.6B+ | Market cap for tokenized U.S. government bonds |

| $1.9B | In commodity-backed tokens (primarily gold) |

| $558M+ | In active private credit loans |

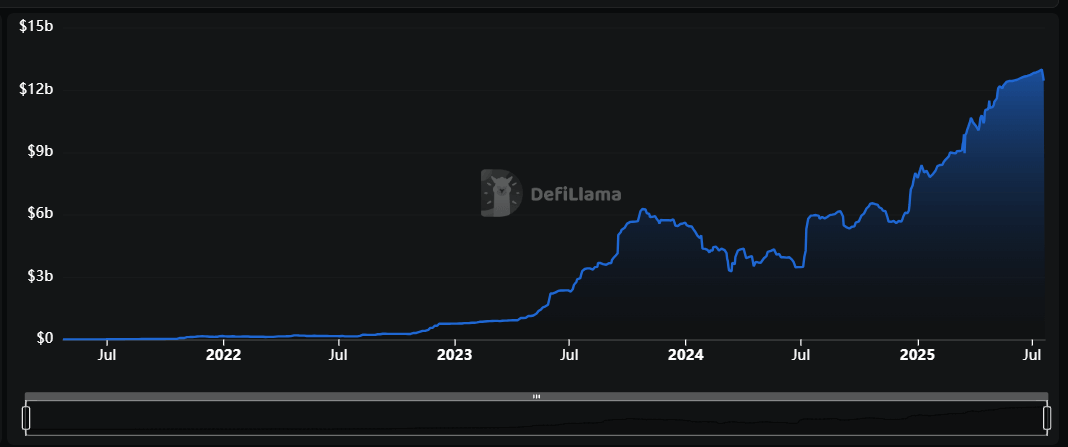

| $12.5B TVL | In RWA protocols |

Notable moves:

- BlackRock’s BUIDL Fund has launched treasury tokenization operations

- JPMorgan's Tokenized Collateral Network represents one of the notable tokenization projects

- MiCA in Europe and the GENIUS Act in the U.S. create legal clarity through their implementation.

- Major exchanges have initiated exploration of tokenized stock products

RWAs are gaining real traction, not just in headlines, but in on-chain usage.

Tokenizing real-world assets sounds complex, but we’re here to make it simple.

We provide everything you need to build, launch, and scale RWA-powered applications without worrying about blockchain infrastructure.

Here’s how:

Use Tatum’s unified RPC gateway to interact with over 100 blockchains, including Ethereum, Polkadot, and recently Lumia. No need to run your own nodes or maintain custom endpoints.

Our Blockchain Data API gives you fast, standardized access to on-chain information, balances, token ownership, transaction history, smart contract state, and more. Ideal for tracking tokenized real estate, commodities, or treasuries.

Tatum’s blockchain notifications let you track events like asset transfers, collateral updates, or token mints, and trigger real-time automation inside your app or platform.

Handle transactions and ownership securely using Tatum’s built-in key management system, ensuring your app stays compliant and protected, even when dealing with high-value, real-world-backed tokens.

From smart contract interaction to real-time monitoring, Tatum gives you production-grade tools that abstract complexity and let you focus on your product, not the plumbing.

Whether you're minting tokenized real estate, tracking treasury yield, or collateralizing loans with physical assets, Tatum has you covered.

The most mature ecosystem for tokenized assets and DeFi integrations.

Use Tatum’s RPC & API suite to:

- Deploy ERC-20 and ERC-721 RWA token.

- Integrate on-chain credit protocols

- Use stablecoins and tokenized treasuries as collateral

Home to RWA-native parachains like Centrifuge, Energy Web, and Composable Finance.

Use Tatum's Polkadot RPC to test RWA integrations and experiment with cross-chain token logic.

We now support the whole DotSama ecosystem, Polkadot, Kusama, Asset Hubs, testnets

Lumia is a next-gen zkEVM chain built with Polygon CDK and secured by Agglayer, and now fully supported by Tatum.

Why Lumia matters:

- $220M+ real estate project (Lumia Towers) already tokenized

- First native dApp layer on a dedicated RWA chain

- Integrated with Agglayer for cross-chain liquidity

- Custom-built infrastructure for capital efficiency, finality, and compliance

We added Lumia to Tatum specifically to power RWA builders, real estate marketplaces, yield platforms, fractional ownership dApps, and beyond.

| Use Case | Recommended Chains |

|---|---|

| Institutional Treasuries | Ethereum, Base, Lumia |

| Real Estate | Lumia, Polkadot, Tezos |

| Private Credit | Centrifuge (Polkadot), Ethereum |

| Commodities (Gold) | Ethereum (PAXG, XAUT), Stellar |

| Energy/Carbon RWAs | Energy Web (Polkadot), Celo |

| Retail Fractionalization | Polygon, Sui, Lumia |

RWAs are the bridge between traditional finance and Web3.

They bring real-world value on-chain, unlock new markets, and offer investors globally accessible yield. With institutions entering fast, the opportunity to build is now.

Build blockchain apps faster with a unified framework for 60+ blockchain protocols.