The Crypto 101: Blockchain and Crypto Essentials

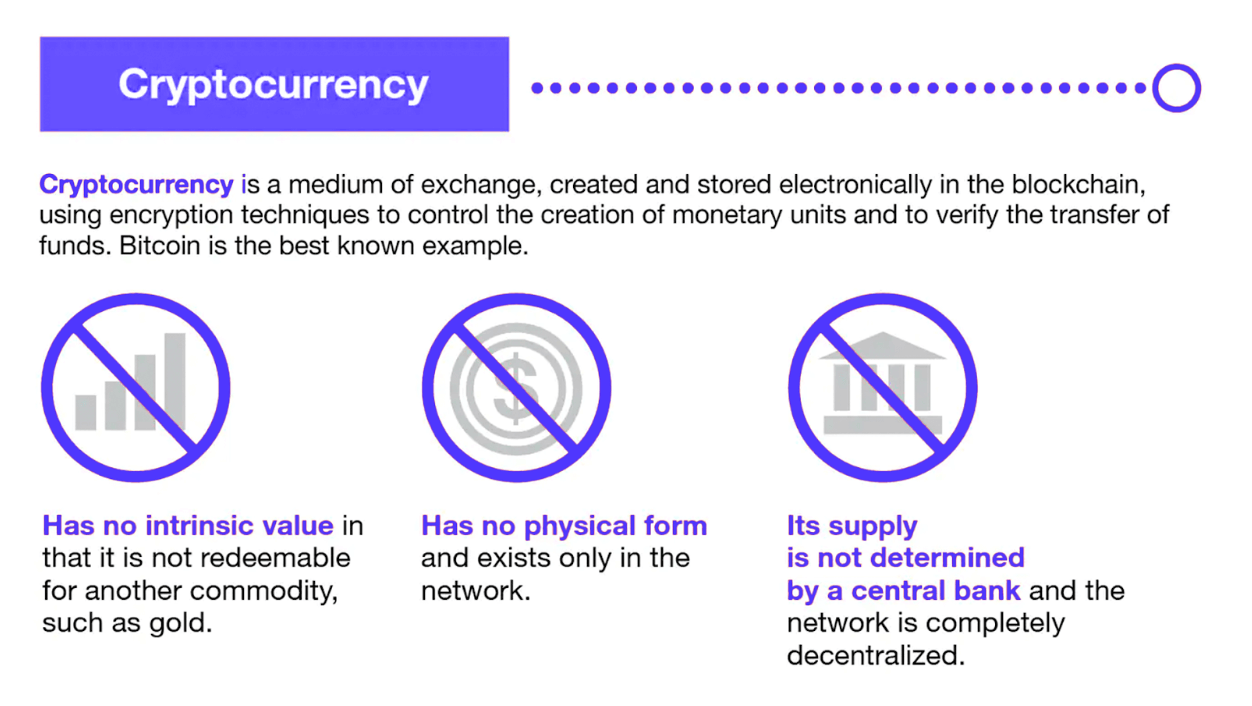

Cryptocurrency is like digital money.

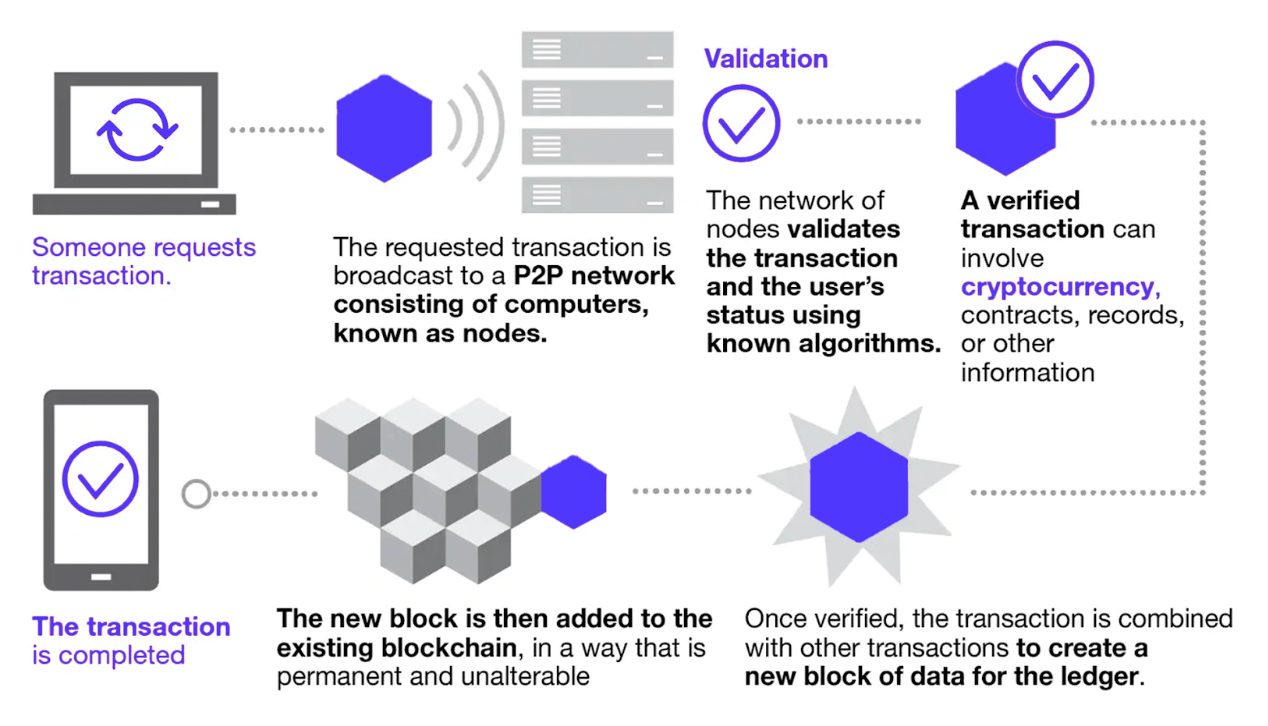

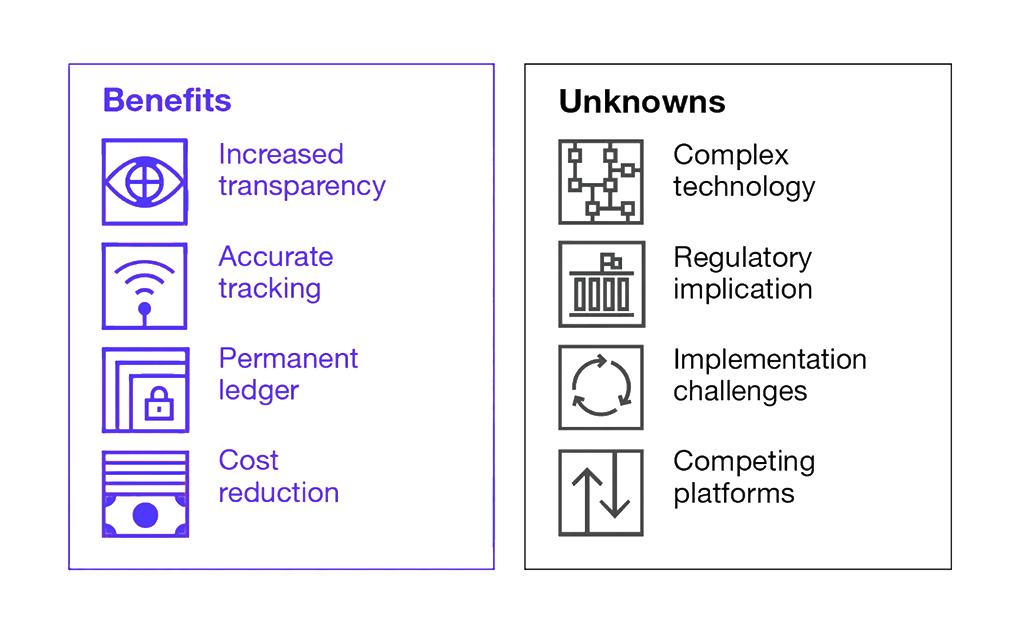

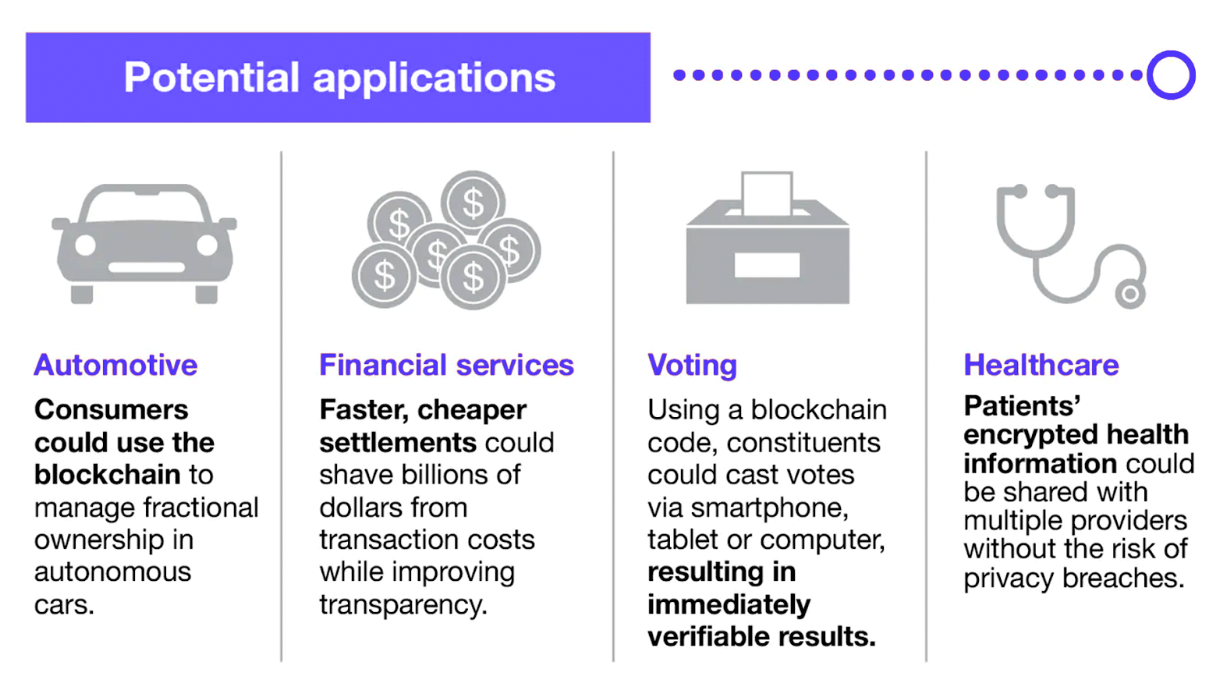

Blockchain is the network on which the “money” transactions happen. A blockchain is a decentralized ledger of all transactions across a peer-to-peer network. Using this technology, participants can confirm transactions without a need for a central clearing authority. Potential applications can include fund transfers, settling trades, voting, and many other issues.

NOTE: Most cryptocurrencies have their own blockchains with their own rules. Some blockchains support different types of cryptocurrencies.

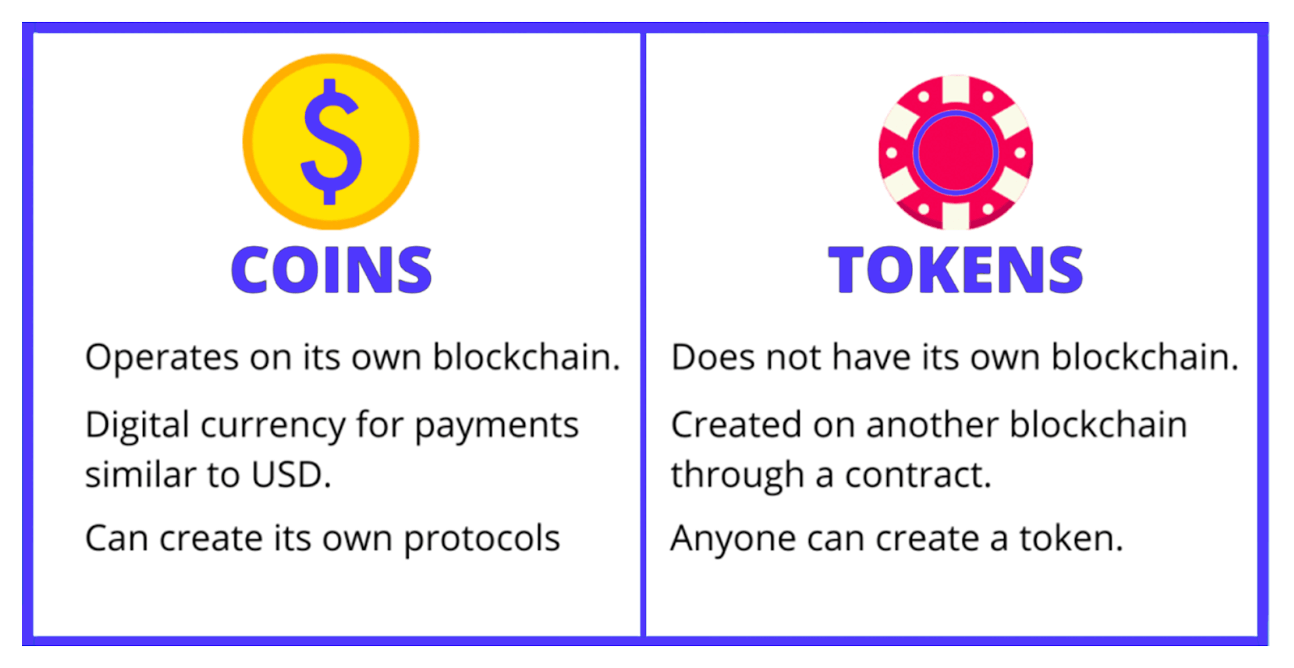

Cryptocurrencies generally fall into one of two categories:

NOTE: The term altcoin refers to all cryptocurrencies other than Bitcoin. Some main types of altcoins include mining-based cryptocurrencies, stablecoins, security tokens, and utility tokens.

When Bitcoin first came out, it set the standard for what it means to be a coin. There are clear-cut qualities that distinguish crypto coins from tokens, which are similar to real-world money.

A blockchain keeps track of all transactions that involve its native crypto coin.

When you pay someone with Ethereum, the receipt goes to the Ethereum blockchain. If the same person pays you back later with Bitcoin, the receipt goes to the Bitcoin blockchain. Each transaction is protected by encryption and is accessible by any member of the network.

Bitcoin was created for the sole purpose of replacing traditional money. The paradoxical appeal of transparency and anonymity inspired the creation of other coins, including ETH, NEO, and Litecoin.

You can purchase merchandise and services from many major corporations today, such as Amazon, Microsoft, and Tesla, using crypto coins. Bitcoin has recently become an official currency of El Salvador alongside the US dollar.

You can earn crypto coins in two ways.

Unlike coins, tokens do not have their blockchain. Instead, they operate on other crypto coins' blockchains, such as Ethereum. Some of the most commonly seen tokens on Ethereum include BAT, BNT, Tether, and various stablecoins like the USDC.

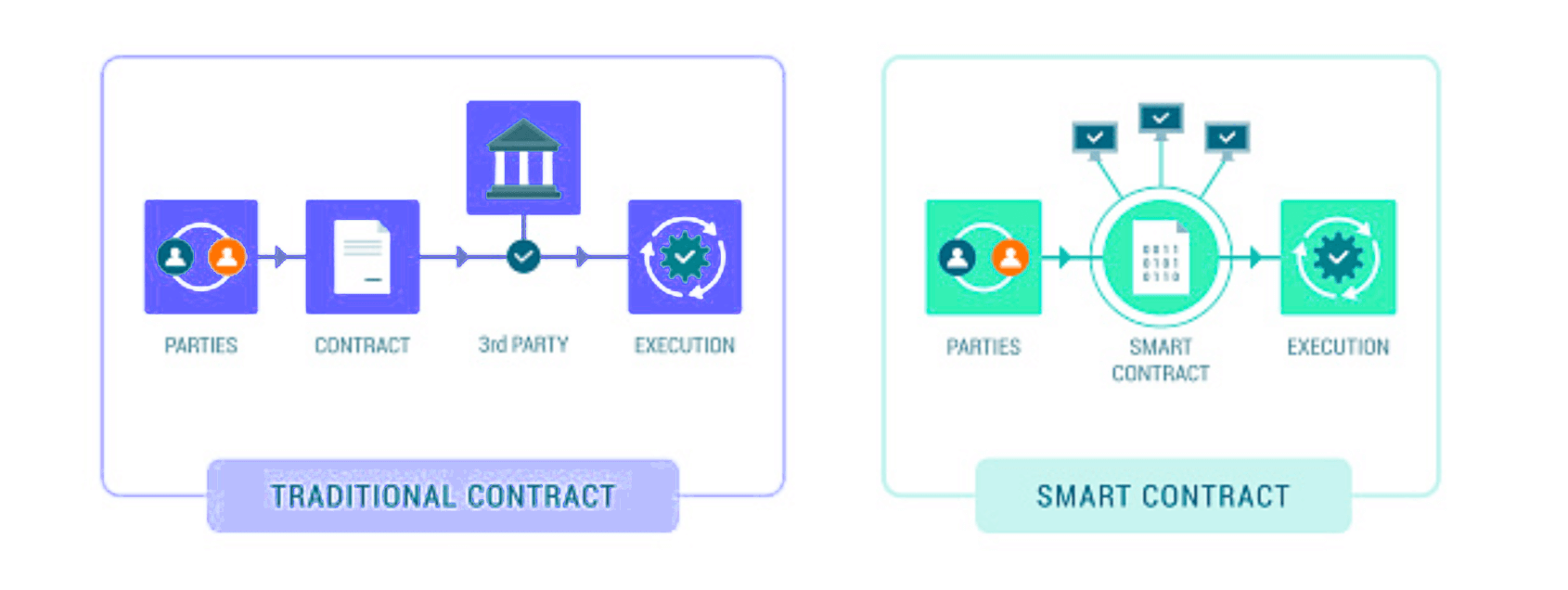

If crypto coin transactions are handled by blockchain, then tokens rely on smart contracts. They're an array of codes that facilitate trades or payments between users. Each blockchain uses its smart contract. For example, Ethereum uses ERC-20, and NEO uses Nep-5.

This is different from coins because crypto coins do not move around; only account balances change. When you transfer money from your bank to someone else's, your money doesn't go anywhere. The bank changed the balances of both accounts and kept the fees. The same thing happens with blockchain - the balance in your wallet changes, and the transaction notes that.

Another notable difference between tokens and coins is what they represent. While crypto coins are essentially digital versions of money, tokens can stand for assets or deeds.

You can buy tokens with coins, but some tokens can carry more value than any of them. For example, a company's share. However, since there are usually restrictions to where you can spend a token, it doesn't have the liquidity a coin offers.

Simply put, a token represents what you own, while a coin denotes what you're capable of owning.

Smart contracts are programs stored on a blockchain that run when predetermined conditions are met. They typically are used to automate the execution of an agreement so that all participants can be immediately certain of the outcome, without any intermediary’s involvement or time loss. They can also automate a workflow, triggering the next action when conditions are met.

Smart contracts work by following simple “if/when…then…” statements that are written into code on a blockchain. A network of computers executes the actions when predetermined conditions have been met and verified. These actions could include releasing funds to the appropriate parties, registering a vehicle, sending notifications, or issuing a ticket. The blockchain is then updated when the transaction is completed. That means the transaction cannot be changed, and only parties who have been granted permission can see the results.

A public ledger derives its name from the age-old record-keeping system used to record information, such as agricultural commodity prices, news, and analysis.

A node, in the world of digital currency, is a computer that connects to a cryptocurrency network (blockchain). The node or computer supports the network. It supports it through validation and relaying transactions. At the same time, it also gets a copy of the full blockchain.

Any computer that connects to the Bitcoin network, for example, is a node. There are different categories of nodes.

Regarding nodes in the Bitcoin network, bitcoin wiki says the following:

“Any computer that connects to the Bitcoin network is called a node.”

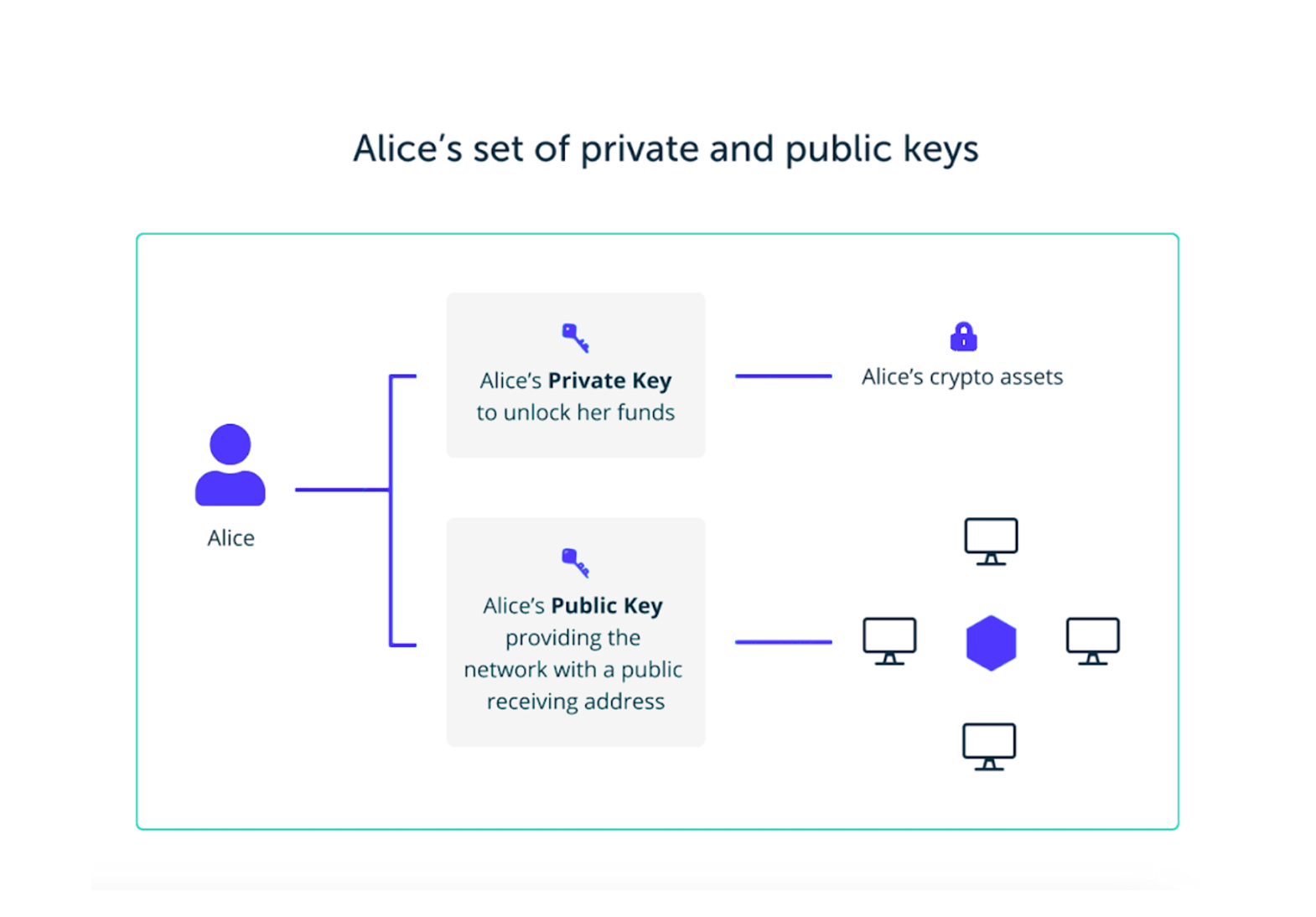

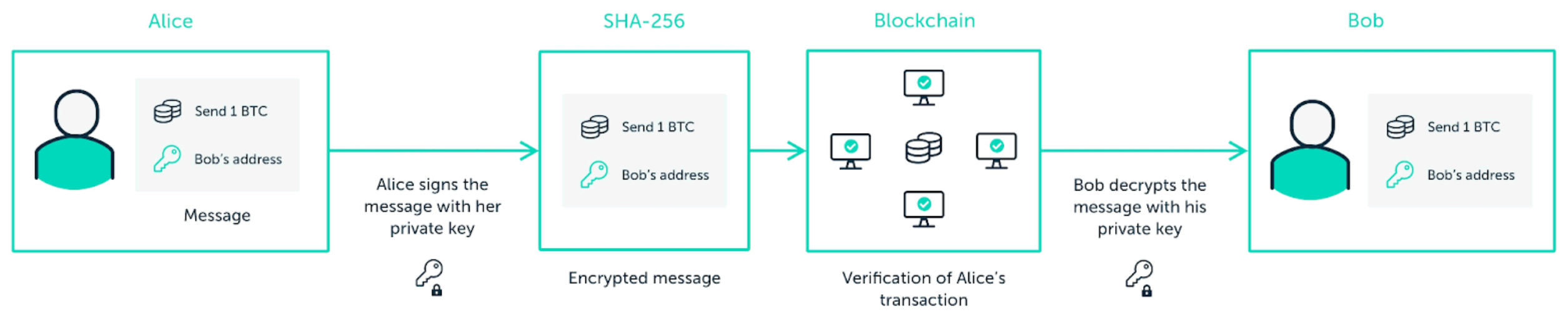

When you buy crypto, what you really own is an address on the blockchain, and the private keys (cryptographic code) that control that address. The blockchain itself keeps track of how many coins or tokens are in that address at a given moment.

Your coins are not in any sort of account: they exist on the blockchain, and are managed solely by you. This means that it is your responsibility to ensure they remain truly and safely yours.

The first thing to understand is that buying crypto assets doesn’t mean physically owning the coins. Because digital money is not tangible and does not exist physically. What you really own instead is called a “private key”. And this is precisely what you need to protect.

Once a transaction has been made on the blockchain, there is no turning back. This means you are the only one in charge to secure your crypto assets, as well as the only one responsible for the decisions you will make.

“Index” in Tatum wallets allows to find the position in the list for a Public Address & associated Private key, bound to its XPUB.

It’s possible to have within the same seed/mnemonic address several XPUB for coins and tokens, or you can create with Tatum individual mnemonic seeds for each coin. That’s up to the end user.

For “cold wallets” (meaning, mnemonics never got shared or exposed online, on a PC, internet, etc) like Ledger.com (hardware wallet) within 1x mnemonic (seed) of this hardware wallet, you can “store” (storage happens in the blockchain, what matters is keeping the seed/mnemonic and Private keys off the Internet) BTC, ETH, and many other coins and tokens.

However, depending on the purpose of our customers, they may or may not want to have multiple coins within the same seed/mnemonic and have instead an individual mnemonic per each coin.

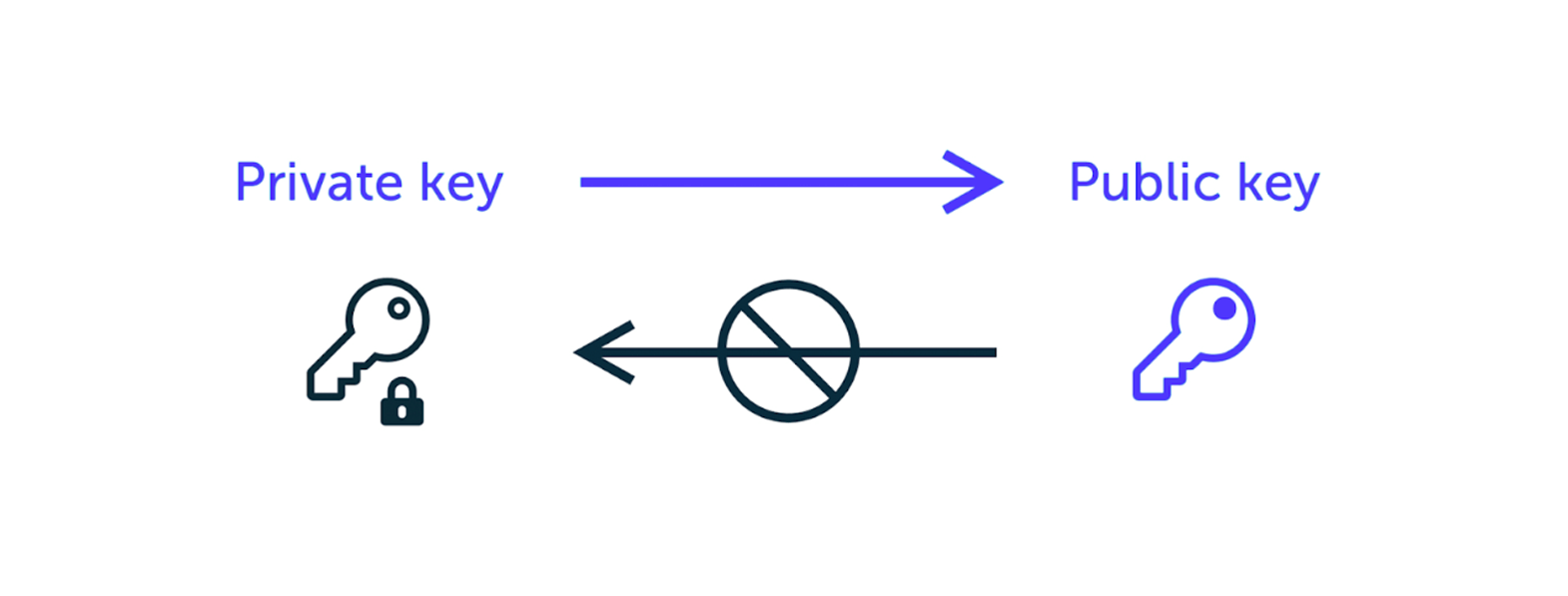

When it comes to crypto, there is no tangibility such as with fiat currencies or commodities. It’s fully digital. To allow for a secure network, cryptocurrencies work based on a double system of private key and public key.

The public key is a public receiving address that any user in the network can send crypto to. It would be similar to your bank account number, such as IBAN or SWIFT, or your email address.

Linked to your public key, there is your private key. This one is comparable to an actual key as it unlocks the right for its owner to access and spend the associated cryptocurrencies. Your private key is yours and only yours, and should therefore remain private. This means that anyone that has access to the private key will possess the funds. Your private key would be similar to your bank account password. Sharing your private key would be like sharing your online banking password or credit card pin.

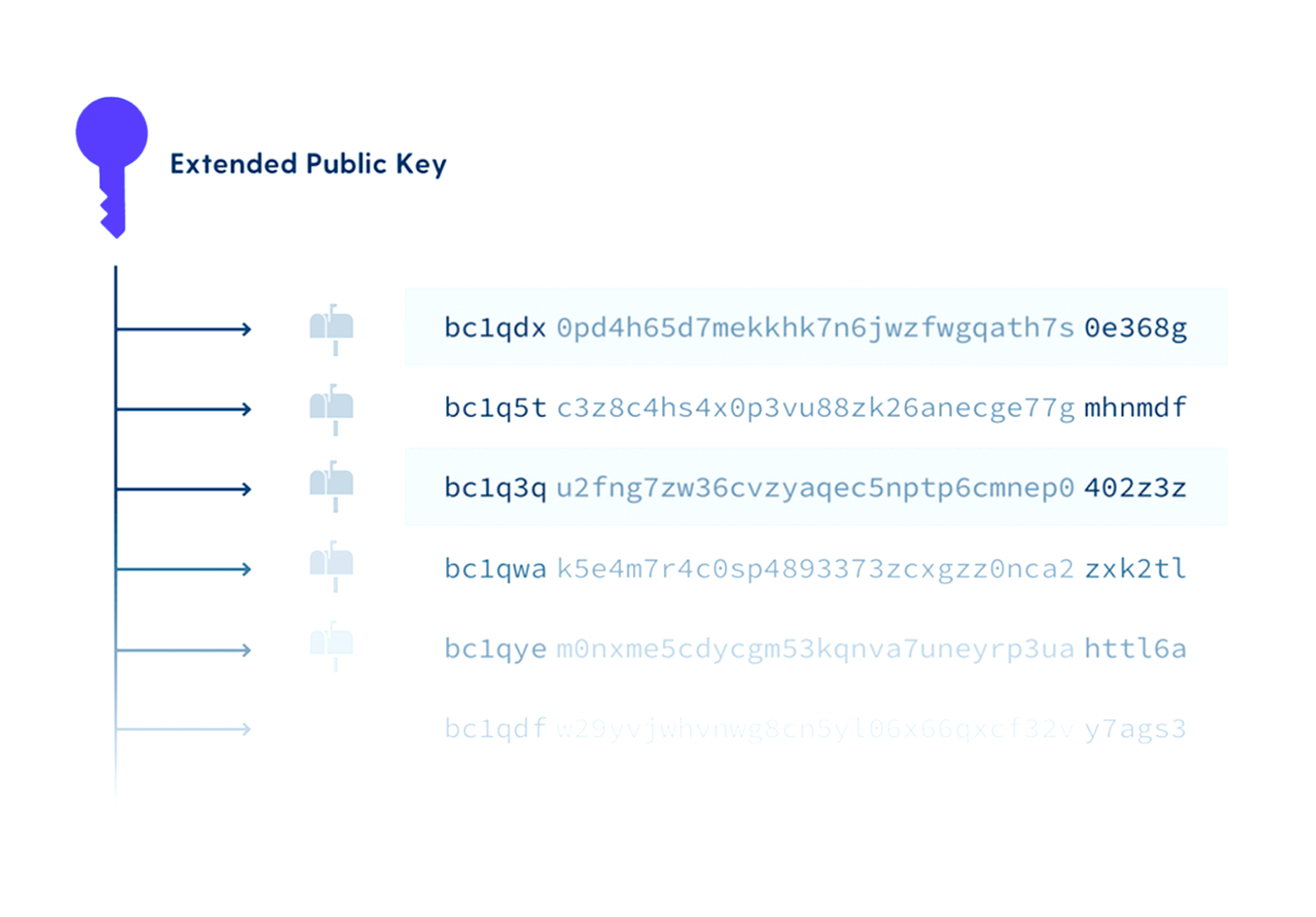

An extended public key, or xpub, is a public key that can be used to derive/create child public keys.

With Bitcoin, to maintain anonymity, it’s recommended that you create a new address for each transaction. Unless the Bitcoin XPUB is publicly shared, no one will be able to trace back all the associated transactions to you. The XPUB holds the index of all associated Bitcoin Addresses in your wallet.

Even though the XPUB itself does not sign transactions, for anonymity's sake, you want to keep your XPUB private to you.

Bitcoin uses the “UTXO model” meanwhile Ethereum uses the “Account model”.

In Bitcoin, transactions are a series of users sending and receiving bitcoins to each others’ public addresses as inputs and outputs in Bitcoin’s UTXO transaction model. Alice can publish her public key on the web, and people can send bitcoins to that address knowing that Alice is the owner of the private key to those funds.

More generally, nodes (people running the Bitcoin software) in Bitcoin automatically check and validate transactions in the network to make sure none of them were forged using basic consensus rules and cryptographic proof that the public/private key pairs are valid (Proof of work). As a result, it is nearly impossible to forge transactions in cryptocurrencies like Bitcoin that use PKC since they are protected by the assumptions of mathematical proofs.

Rather than following in Bitcoin’s footsteps, Smart Contract (SC) focused blockchains (e.g. Ethereum) employ an “account model” strategy. Instead of having each coin be uniquely referenced (UTXO), coins are represented as a balance within an account. Accounts can either be controlled by a private key or an SC.

One important difference between UTXO-based blockchains and account-based blockchains is that UTXO transactions specify the resulting state exactly. We know what the result will be when we apply the transaction. The resulting coin locations are embedded in the transaction itself. This is not so with an account-based system.

Transactions in an account-based system rely on the existing state and are therefore known as stateful. This allows more flexibility with the expense of more moving parts. The reason why you don’t see SC on the Bitcoin blockchain since the complexity would be too high to make it happen. The Ethereum blockchain makes it way easier to handle SC.

Mainnet is the term used to describe when a blockchain protocol is fully developed and deployed, meaning that cryptocurrency transactions are being broadcasted, verified, and recorded on a distributed ledger technology (blockchain).

Testnet describes when a blockchain protocol or network is not yet up and running at its full capacity. A testnet is used by programmers and developers to test and troubleshoot all the aspects and features of a blockchain network before they are sure the system is secure and ready for the mainnet launch.

Similar to the testnet, the development network or devnet operates independently of the mainnet. Although not every blockchain protocol utilizes both a devnet and a testnet, some differentiate these environments based on their intended use.

For example, the Solana protocol has a devnet working as its “playground” for those looking to experience the protocol as a blockchain user, token holder, app developer, or network validator. In contrast, the Solana blockchain testnet serves as an environment where recent releases undergo a stress test that focuses on network performance, stability, and the behavior of network validators. Like Testnet, devnet cryptocurrency generally has no “real” value. For devnet blockchains, users can also mine cryptocurrency or access faucet services to obtain coins.

NOTE: Tatum TESTNET API KEYs also work on specific Devnets.

Build blockchain apps faster with a unified framework for 60+ blockchain protocols.