Blockchain Fees Comparison Guide: All You Need to Know

Blockchain technology is constantly evolving and expanding, bringing with it new applications and platforms. With the increasing saturation of the market, users and developers are becoming increasingly concerned about the costs associated with different blockchains. In this article, we will provide an in-depth analysis of the fee structures of some of the most popular blockchains, including Bitcoin, Ethereum, TRON, and Solana. We will explore the fees charged by each platform and how they compare to each other, as well as factors that can affect fee structures such as network congestion, transaction volume, and gas fees. To help you navigate the world of blockchain technology, we will also provide details on how to estimate fees using Tatum API endpoints for the applicable active blockchain. By the end of this article, you will have a comprehensive understanding of blockchain fee structures and the tools needed to estimate fees on different blockchains using Tatum API endpoints.

[.c-text-center]Tatum gives you reliable infra and tools you need to build blockchain apps in a fraction of time. [.c-text-center]

[.c-wr-left][.button-black]Get Started[.button-black][.c-wr-left]

Bitcoin's transaction fees play a crucial role in the network by incentivizing miners to process transactions and add them to the blockchain. These fees are calculated based on the size of the transaction in bytes rather than the transaction amount itself. Although the fee structure can be quite complicated, it is important to understand its core elements.

Transaction fees are typically measured in satoshis per byte (sat/byte), where a satoshi is the smallest unit of Bitcoin (0.00000001 BTC). Miners prioritize transactions with higher fee-to-size ratios, or feerates, which means that transactions with a higher fee per byte are more likely to be included in the blockchain.

To determine the appropriate fee for a transaction, you need to know the transaction size and the required feerate. For instance, if your transaction size is 16,000 bytes and the necessary feerate is 10 sat/byte, the transaction fee would be 10 x 16,000 = 160,000 satoshis. The required fee rate varies depending on network congestion, with higher demand for transactions leading to higher fees.

Bitcoin Cash (BCH) is a fork of Bitcoin (BTC) that aims to improve the cryptocurrency's usability as a peer-to-peer electronic cash system. One significant difference between the two is the fee structure. BCH transactions typically cost less than a penny, while the median on-chain BTC transaction fee has been between $1 and $15 since 2020.

The fees for Bitcoin Cash are not fixed but vary based on the supply (block space) and demand (transaction volume) in their respective markets. The larger maximum block size (32 MB) in Bitcoin Cash as compared to Bitcoin (1 MB) allows for a higher volume of transactions to be processed on-chain, reducing the cost per transaction and increasing transaction speed and reliability.

To calculate the fee for a Bitcoin Cash transaction, you can use the following formula:

transaction_fee = transaction_size * fee_rate

The transaction_size is the number of bytes the transaction occupies, and the fee_rate is the fee per byte. For instance, if a transaction occupies 250 bytes and the current fee rate is 1 satoshi per byte, the transaction fee would be 250 satoshis.

Litecoin (LTC) has a fee structure that is designed to make it more user-friendly than Bitcoin.The priority of a transaction is determined by coin days destroyed divided by transaction size, and transactions that meet a certain priority level can be sent for free.

If the priority is too low, a fee of 0.001 LTC per KB is charged, although this is set to be lowered to 0.0001 LTC per KB in the next release. There are a couple of factors to consider when calculating the transaction fee, including input and output size and dust mitigation.

Compared to Bitcoin, Litecoin has significantly lower transaction fees.

Dogecoin's new fee structure has been implemented to decrease overall transaction fees and encourage node operators to relay low-fee transactions to miners. The new fee structure has been introduced gradually over multiple software releases. Some of the key changes include reducing the minimal relay fee from 1 DOGE to 0.001 DOGE and decreasing the dust limit to 0.01 DOGE, which will incentivize the use of microtransactions. Additionally, a default block inclusion fee rate of 0.01 DOGE has been defined, which will incentivize miners to confirm transactions on the soonest available block while disincentivizing spam transactions.

Ethereum's transaction fee system revolves around the concept of "gas," which is used to allocate resources for computations, data storage, and token transfers. Prior to August 2021, Ethereum used a first-price auction model for gas fee calculations. However, with the implementation of EIP-1559, a new fee model is now in place.

Under the new model, the total transaction fee is determined by the gas unit (limit) multiplied by the sum of the base fee and tip. The base fee, which is introduced with the London network upgrade, is the minimum price per unit of gas for inclusion in a block and is calculated based on the current demand for block space. The priority fee (tip) is used to reward miners and is often set automatically by most wallets. The base fee is burned, meaning it is removed from circulation.

To calculate the total transaction fee using the new model, the formula is:

Total transaction fee = gas units (limit) * (base fee + tip)

Ethereum's gas fees can be high due to the popularity of the network, as more complex decentralised applications consume more gas and take up more space in the limited-sized blocks. This can be both positive and negative since high gas fees indicate interest and active users on the network but make it difficult for average users to afford transactions.

Ethereum 2.0 aims to address the issue of high gas fees by implementing a new consensus mechanism and sharding, which should increase the network's capacity and reduce fees.

Polygon's fee structure revolves around two main components: StdTx and the Bor Fee Model. StdTx is a feature of the Heimdall layer that allows developers to create their blockchain applications on the Polygon network without paying fees for every transaction. Polygon supports a limited range of transaction variants, and end users do not deploy any type of contract on Heimdall. This validates the fixed fee model in StdTx.

The Bor Fee Model is another essential component of the Polygon fee structure. It collects fees in the form of MATIC tokens for normal transactions and distributes them among block producers. MATIC serves as the primary token for paying gas fees for Polygon transactions as well as staking purposes. The Bor Fee Model supports the efficiency of the Bor layer, which has a transaction speed of almost 2 to 4 seconds.

Polygon's fee structure is a combination of the StdTx fixed fee model and the Bor Fee Model. Developers do not need to pay fees for every transaction within the application using StdTx, and end users do not deploy any contracts on Heimdall. The Bor Fee Model collects and distributes fees in the form of MATIC tokens, which are used to support the efficient processing of transactions on the network, with a focus on low gas fees and fast transaction speeds.

To give an example, when a user initiates a transaction on the Polygon network, the Bor layer collects a fee in the form of MATIC tokens, which are then distributed among block producers. This process ensures that the transaction is processed quickly and efficiently, with a transaction speed of 2 to 4 seconds. Developers can create blockchain applications on the Polygon network with low gas fees, and end-users can enjoy a seamless experience without having to deploy any contracts on Heimdall. Overall, Polygon's fee structure is designed to provide an efficient and cost-effective solution for developers and users, making it an attractive option for building scalable decentralised applications.

Binance Smart Chain (BSC) uses a gas system to determine transaction fees, similar to Ethereum. The fees are based on the computational resources required for executing transactions and smart contracts, and are denominated in Gwei, which is a small denomination of BNB equal to 0.000000001. Users can set their gas prices to prioritise their transactions being added to the block.

To calculate transaction fees on BSC, you need to consider the gas price and the gas limit. The gas price is the amount of BNB you're willing to pay for each unit of gas, while the gas limit is the maximum amount of gas you're willing to use for the transaction. The total transaction fee is determined by multiplying the gas price by the gas used.

The fee structure of the TRON network consists of three main components: bandwidth, energy, and transaction fees. Let's dive into each component and provide examples and formulations.

Let's consider an example:

Using the formulas above, we can calculate the costs:

Bandwidth cost: (200 / 100,000,000) * 1,000 = 0.002 TRX

Energy cost: (50,000 / 200,000,000) * 2,000 = 0.5 TRX

Transaction fee: 200 * 0.00001 = 0.002 TRX

In this example, the total cost for the user would be 0.504 TRX (0.002 TRX for bandwidth, 0.5 TRX for energy, and 0.002 TRX for the transaction fee).

Solana is a blockchain platform that prioritises fast and low-cost transactions. The fee structure of Solana is designed to incentivize validators and cover the computational and storage resources required for processing and storing transactions.

Solana's fee system consists of a base fee and a per-signature fee. The base fee is a fixed value charged for every transaction, which currently stands at 5000 lamports (0.00005 SOL) and is meant to cover the cost of storage. The per-signature fee is charged based on the number of signatures included in the transaction and is calculated by multiplying the number of signatures by the current fee rate. The fee rate is determined by the network's congestion, and it can be found using the Solana CLI or the Solana JSON-RPC API.

To calculate the total transaction fee, add the base fee to the per-signature fee multiplied by the number of signatures. For instance, if a transaction has two signatures, and the per-signature fee rate is 1000 lamports (0.00001 SOL), the total transaction fee would be 7000 lamports (0.00007 SOL).

The transaction fees collected are distributed among validators as rewards for securing the network. Overall, Solana's fee structure aims to provide a cost-effective and efficient blockchain platform that prioritises user experience.

XRPL’s fee structure is designed to prevent spam and ensure efficient transaction processing. XRPL has two types of fees: base fees and load fees.

Base Fees: These fees are the minimum transaction costs required to perform a specific operation on the XRPL. The fees are denominated in XRP and have a fixed value, known as the "base fee" or "reference fee." Different transaction types have varying base fees. For example, as of today (04/29/2023), the base fee for a standard transaction is 0.00001 XRP.

Here are some common transaction types and their respective base fees:

Payment: 0.00001 XRP

OfferCreate (place an order): 0.00001 XRP

OfferCancel (cancel an order): 0.00001 XRP

AccountSet (set account options): 0.00001 XRP

TrustSet (create or modify a trust line): 0.00001 XRP

Load Fees: These fees are dynamic and can be adjusted based on the current network conditions. Load fees are expressed as a multiplier of the base fee. If the network is congested, the load fees may increase, resulting in higher transaction costs.

The effective transaction cost is calculated using the following formula:

effective_transaction_cost = base_fee * load_fee

For example, if the base fee for a payment transaction is 0.00001 XRP, and the current load fee is 1.5x, the effective transaction cost would be:

effective_transaction_cost = 0.00001 * 1.5 = 0.000015 XRP

Unlike other blockchain networks, transaction fees on XRPL are not paid to validators or miners. Instead, the fees are destroyed, leading to a decrease in the total supply of XRP over time.

[.c-wr-center][.button-pr]Start for Free[.button-pr][.c-wr-center]

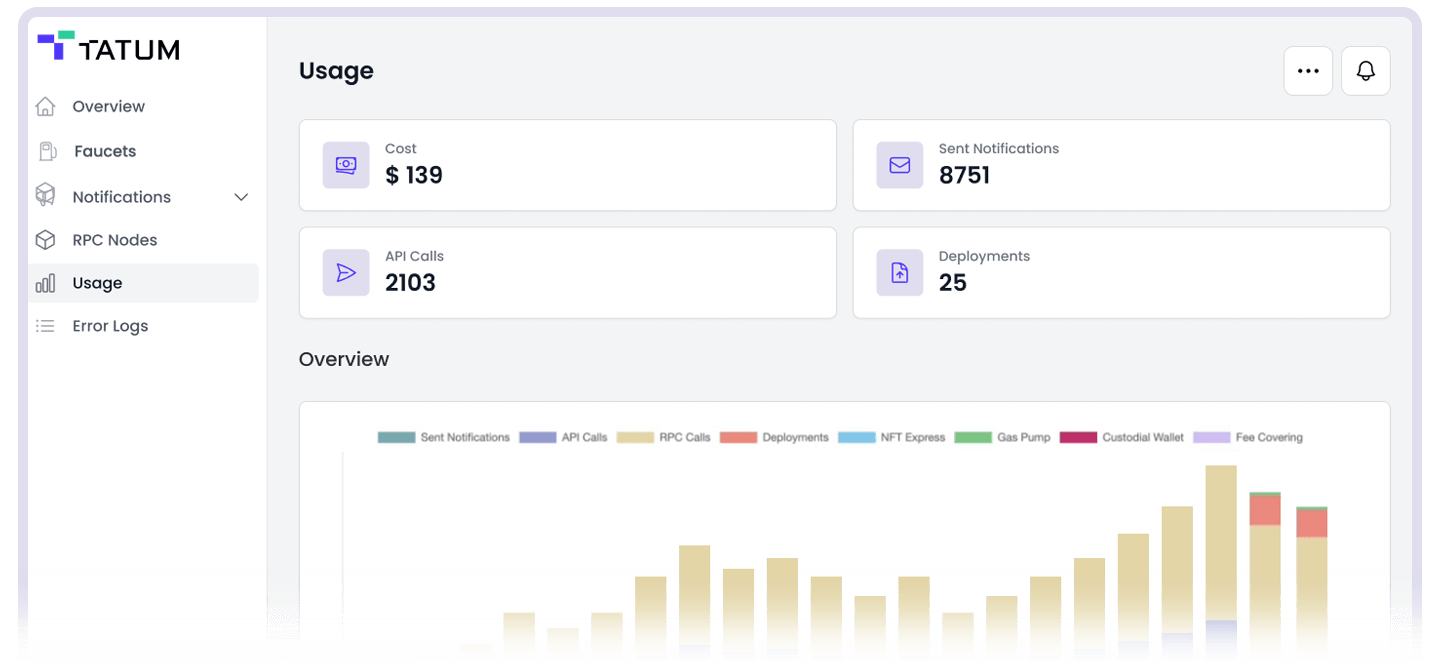

Retrieve and showcase the current gas fee for various blockchain networks!

[.c-wr-center][.button-black]Visit GitHub[.button-black][.button-out]Read Docs[.button-out][.c-wr-center]

Build blockchain apps faster with a unified framework for 60+ blockchain protocols.