The 7 Most Common Crypto Scams of 2025. (And How To Avoid Them)

.jpg)

From fake investment “opportunities” to AI-generated deepfakes and love-turned-fraud, scammers are evolving just as fast as the technology they exploit.

The results?

Billions of dollars lost every year, not from exchange hacks or code exploits, but from manipulation, persuasion, and trust.

These are social engineering scams, schemes that convince people to hand over their crypto willingly. No smart contract exploit required. Just human psychology.

Here’s a look at how and how much money has been stolen by crypto scammers over the past few years, and why awareness is still your best defense.

Any scheme that steals your coins (BTC, ETH, USDT, etc.) or tricks you into sharing sensitive info (seed phrase, private keys, passwords) by posing as an exchange, advisor, love interest, or “can’t-miss” investment.

Why scammers love crypto

How it works: A slick “manager” dangles oversized, fast returns and shows you a polished dashboard with fake profits. Withdrawals get mysteriously “fee-gated” or “KYC-blocked,” then the site ghosts. Often the “support team” keeps you paying to “unlock” funds.

Red flags: Guaranteed yields, countdowns, pay-to-withdraw, anonymous team, vague whitepaper, celebrity/“expert” endorsements (frequently deepfaked).

How to spot it: Verify the company in multiple sources (not just its own site). Test with a tiny deposit and a tiny withdrawal. If the story changes when you try to exit, that’s your sign.

How it works: A long game on dating apps or chat platforms builds emotional trust, then pivots to “joint investing” on a fake platform. You’ll see staged wins (screenshots, dashboards) and be coached to “top up” to unlock bigger gains. When you ask to withdraw, fees and pressure spike, then they vanish.

Red flags: Avoids video calls or real-life meetings, pushes secrecy (“don’t tell your bank”), introduces crypto out of nowhere, claims convenient “insider” access.

How to spot it: Don’t mix romance and ROI.

If someone you barely know wants you off-platform (WhatsApp/Telegram) and into a private link or app, stop.

Pressure + secrecy = manipulation.

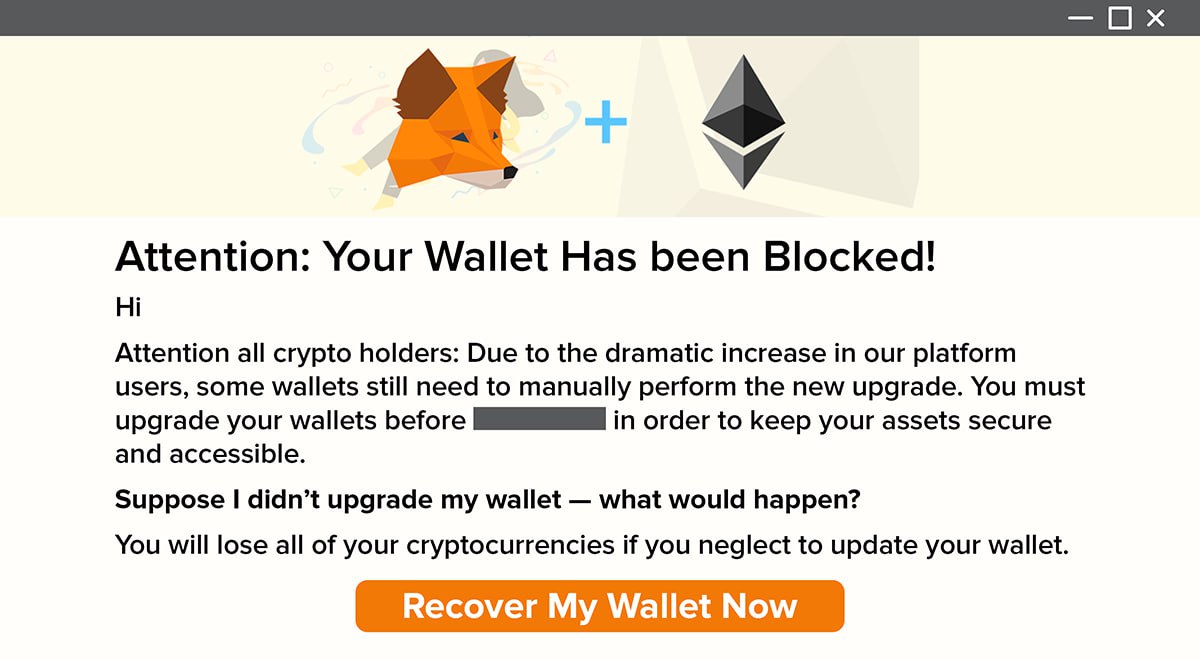

How it works: You get an urgent message: “Your wallet is compromised, log in now.”

The link opens a perfect clone that captures credentials or seed phrases. In community servers, fake “mods” DM first, then direct you to “verify” on a malicious site.

Red flags: Slightly off URLs, grammar/spelling slips, “act now or lose everything,” requests for seed/private keys (legit support will never ask).

How to spot it: Type the URL yourself or use a trusted bookmark. Treat unsolicited DMs as hostile until proven otherwise.

For wallet connections, verify the domain and permissions before signing anything.

How it works: Coordinated promoters hype a micro-cap toke,; price rockets on FOMO and thin liquidit,; insiders dump; chart falls off a cliff. “Partnerships” are often imaginary; “roadmaps” are copy-pasted.

Red flags: Paid promos masked as advice, unverified partnerships, Telegram/Discord groups promising “signals,” no utility beyond “number go up.”

How to spot it: Read independent sources and block explorers.

Check liquidity depth, holder distribution, and whether insiders control most supply.

If the only story is hype, walk away.

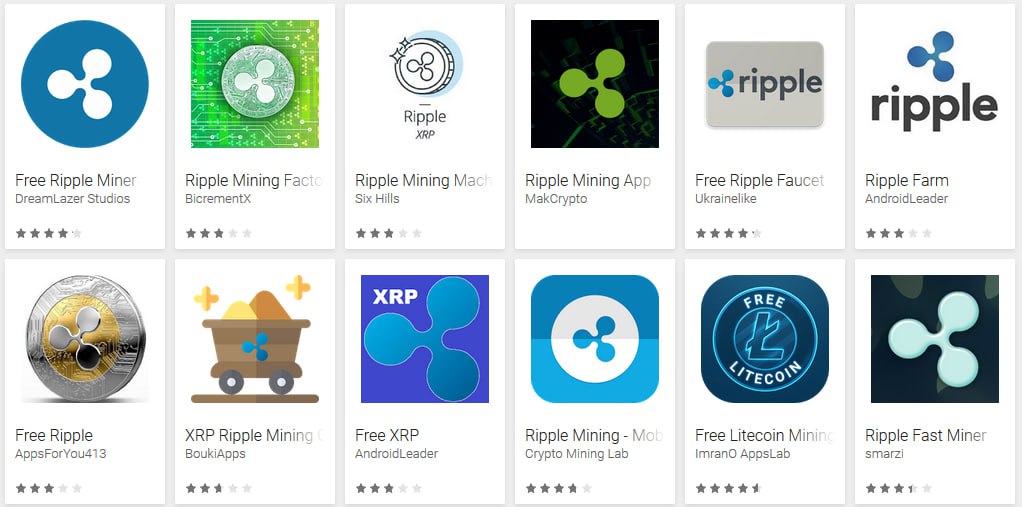

How it works: Malicious apps/extensions impersonate legit wallets/exchanges, requesting excessive permissions or stealing keys.

Sideloaded APKs and TestFlight links are popular vectors.

Some fakes show your real balances, then prompt “security” actions that exfiltrate secrets.

Red flags: Not in official app stores, templated five-star reviews, sketchy publisher accounts, frequent permission prompts, broken features.

How to spot it: Download only via official sites or app stores linked from verified social profiles. Confirm publisher name.

If an app asks for your seed phrase to “restore” outside your control, stop.

How it works: A token/DeFi project launches with buzzy branding and influencer backing. Devs retain minting rights or liquidity control, then yank funds or flip a malicious function. Honeypot tokens may block selling entirely.

Red flags: Anonymous team with no history, unaudited contracts, opaque tokenomics, “can buy but can’t sell,” liquidity not locked or controlled by a single wallet.

How to spot it: Check audits from reputable firms, verify liquidity lock and timelocks, inspect contract permissions, and research the team’s prior repos.

If you can’t independently verify, assume risk is high.

How it works: A fake airdrop/mint or malicious dapp prompts you to connect a wallet and sign a transaction that quietly grants spending approvals.

Automated bots empty tokens the moment conditions are met. “Drainer-as-a-service” kits make this widespread.

Red flags: Random “claim” links, unfamiliar signatures, unlimited approvals, requests outside the dapp’s stated purpose.

How to spot it: Use a burner wallet for new dapps. Read the human-readable permission before you sign.

Regularly review and revoke stale approvals with a reputable token approval tool.

Verify wallet safety in seconds. Paste any address and see if it’s linked to scams, stolen funds, or the dark web. Check a wallet.

Sounds like a stupid tip, but it's actually a pro tip: If CZ DMs you a crypto opportunity, it’s not CZ.

Keep your users, and treasury safer while you scale.

Build it into your flow: Automate checks at signup, withdrawal, or counterparty add with Tatum’s Malicious Address endpoint.

The best alpha isn’t a secret group on Telegram, it’s your own awareness.

Build blockchain apps faster with a unified framework for 60+ blockchain protocols.